Our team at Chin|Fleming|Harris recently took a moment to look back at some “vintage” company newsletters circa 1996, and we were pleasantly surprised to realize that despite current headlines heeding rising interest rates, today’s mortgage rates are still in fact at historic lows.

“We recognize that the choice to get in the game now or wait for some underdetermined time for rates to fall is totally personal and subjective,” says CMFH senior partner Dena Fleming, who shared the archived newsletters with the Park City-based team. “Our point is that rates are at historic lows even when they seem high compared to the last couple of years — and with low inventory, one could miss out while waiting for rates to drop.”

According to a November 2022 report from Investopedia, rising mortgage interest rates are “nothing to fear,” and educating yourself on the subject will go a long way toward easing anxiety around participating in the housing market. Since rising mortgage rates can impact nearly every aspect of buying a home, we’re breaking down some key points to consider when making your decision to “Get in the Game.”

What you should know about rising mortgage interest rates

To provide context, Investopedia took a closer look at data provided by mortgage lender Freddie Mac. Granted, the rates over the last decade have trended at their lowest ever (dating back to records starting in April 1971), but a mortgage today with a fixed rate for the next 30 years is still considerably cheaper than historical comparisons.

The report points out specifically the average mortgage rate at the start of the 2006 recession, which was 6.41%. Ten years earlier — in 1996 — the average mortgage rate was 7.81%, and 10 years before that, in 1986, the average rate was 10.19%. For the record, the average rate in 1976 was 8.87%, and it first reached double digits in 1979. The average mortgage rate didn’t return to steady single digits again until 1991.

Key takeaway: Investopedia concludes that “as long as the economy continues to grow, and the economy continues to see job growth and wage growth, a rise in interest rates should not paralyze the housing market.”

Consider rental opportunities during rising interest rates

The rental market is one possible opportunity to capitalize on during this time, if possible. Rising rates can translate to fewer people qualifying for mortgages, hence, the market for rental properties will increase. An investor could potentially turn a profit more quickly in the right housing market.

Look for a deal

Rising interest rates can mean more costly mortgages, fewer qualified buyers and more expensive purchase prices. But this trend ultimately can lead to lesser demand, and sellers can be inclined to reduce prices. This can be advantageous for a qualified buyer. Look for pricing reductions and/or the opportunity to negotiate as sellers look to attract buyers in a slumping housing market.

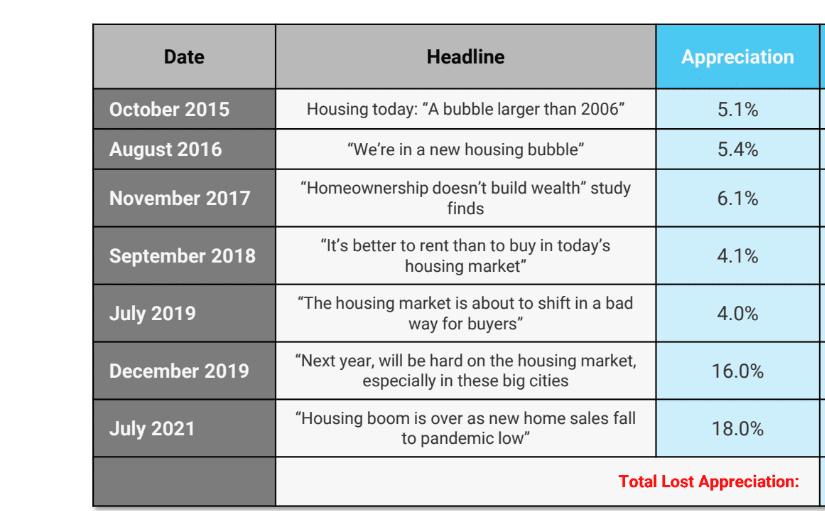

CMFH team member Justin Fleming notes two more benefits from “getting in the game” in today’s climate: “Certainly if someone is buying a property for their personal use and enjoyment, the sooner they get in, the sooner they can start enjoying the property. But also, especially if they are in for the long term, buyers can potentially start earning some appreciation. See the chart below for more perspective:

Who’s investing in real estate despite rising interest rates?

Wondering what others are doing in the real estate market these days? Justin points to two examples of marquee businesses currently making big-time investments in real estate:

- In November, JPMorgan announced it had entered into a joint venture agreement with Haven Realty Capital with a plan to acquire up to $1 billion in build-to-rent properties, starting in Atlanta.

- Just last summer, private equity giant Blackstone Inc. revealed a new real estate fund that would “set a record as the largest vehicle of its kind, defying market volatility and a crowded fundraising landscape.” The new fund, called Blackstone Real Estate Partners X, had commitments totaling $24.1 billion and could go up to $30.3 billion when finalized.

Tips for getting in the real estate game

Shore up your credit score: Investopedia reminds potential investors that credit scores will drastically impact the interest rates on your mortgage. Look to improve your score before applying for a mortgage, if possible.

Negotiate: Due to lower demand caused by rising interest rates, sellers may be looking get their homes off the market with greater urgency – meaning, you may be able to negotiate a lower asking price.

Consider a shorter loan: A recent New York Times report suggests buyers consider a 15-year, fixed-rate loan as an option to “get in the game.” While 30-year, fixed-rate mortgages are the norm, a 15-year, fixed-rate loan comes with lower rates. Of course, this can translate to higher monthly payments, but the report offers yet another option to consider: “You can still take advantage of lower rates by downsizing your purchase to make a 15-year loan affordable — that way, you’ll still be in the game, building equity.”

Get ahead: Additionally, the New York Times suggests making additional payments on your mortgage, if you have the cash. Taking extra “bites” out of what you owe means you’ll pay off the loan sooner, resulting in more savings.

Stay alert: Finally, remember that you’re not truly locked into an interest rate for the duration. When rates fall, do your due diligence. Perhaps it makes sense to refinance your home at a lower rate, or for a shorter term, or maybe your dream home is finally within reach.

Before you go…

Despite some headlines’ alarming tone, the fact remains that current interest rates are comparable to historic lows, which is good news for buyers. Today’s market reflects some of the best mortgage rates a home buyer can expect to attain. But finding the right property and the best mortgage for you is still best navigated with a seasoned real estate expert. Working with an expert assures you’ll feel more knowledgeable, confident and secure in your investment decisions. Reach out to Chin|Fleming|Harris today for a fresh approach to buying or selling Park City real estate!